WBPSC Audit and Accounts Service Exam Syllabus 2022, Exam Pattern @ wbpsc.gov.in: Are you applying for WBPSC Audit and Accounts Service Recruitment 2022? If Yes, then stay here and check out the complete article carefully. The WBPSC Audit and Accounts Service Exam Syllabus 2022 and WBPSC Audit and Accounts Service Exam Pattern 2022 are now available to download from the official website – wbpsc.gov.in. To save the applicants time, We have discussed the details below. Applicants kindly make use of this article and check the complete page carefully. All those who want to get more marks then spend some time learning the syllabus and exam pattern details here.

WBPSC Audit and Accounts Service Exam Syllabus 2022 – Details

| Download WBPSC Audit and Accounts Service Exam Syllabus 2022 Details Here |

|

| Organization Name | West Bengal Public Service Commission (WBPSC) |

| Name of the post | West Bengal Audit and Accounts Service Exam |

| Category | Syllabus |

| Syllabus Status | Available |

| Location | West Bengal |

| Official site | wbpsc.gov.in |

West Bengal PSC Audit and Accounts Service Test Pattern 2022 – Prelims, Mains

The structure of the WBPSC Audit and Accounts Service Test Pattern will help the candidates to know the type of questions that appear in the exam. Moreover, the West Bengal Audit and Accounts Service Exam Pattern consists of two papers namely Preliminary and Mains Examination.

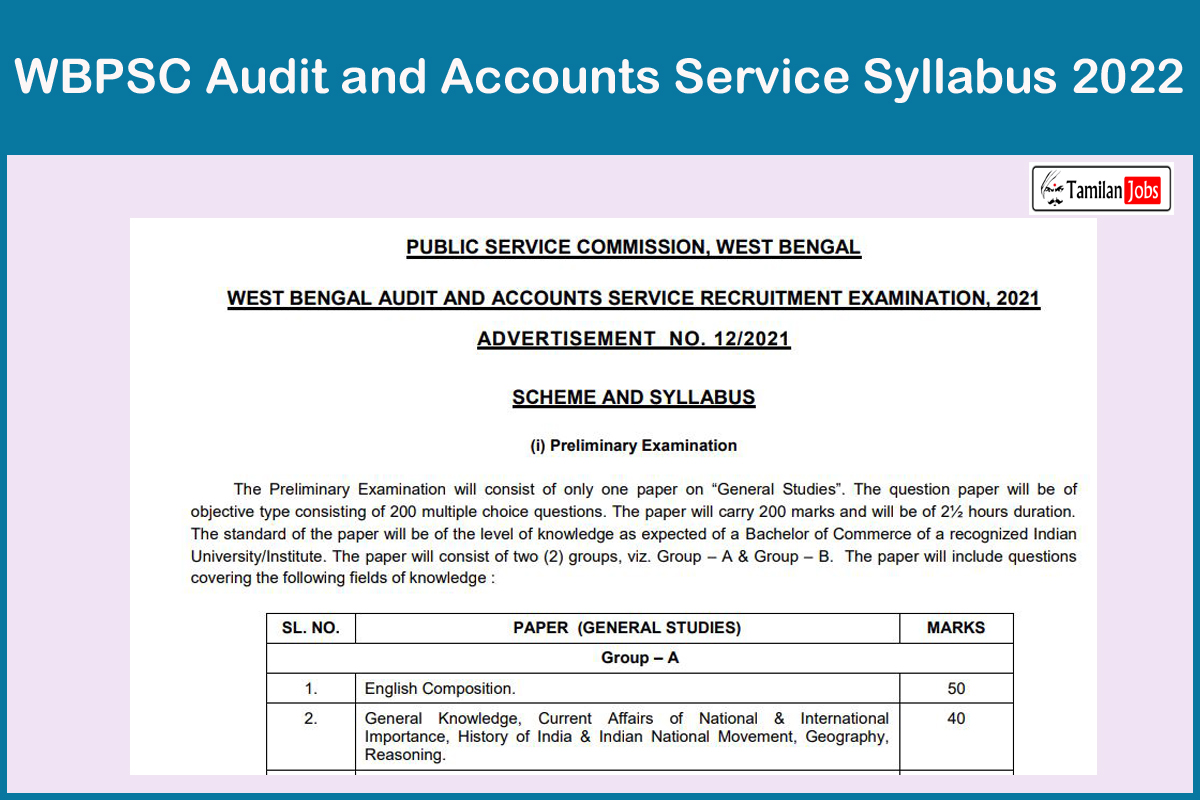

Preliminary Examination

The Preliminary Examination will consist of only one Paper on “General Studies”. The Question Paper will be of objective type of 200 multiple-choice questions. The time duration is 2.30 hours. The preliminary Examination will be for 200 marks.

| S.No | PAPER (GENERAL STUDIES) | Marks |

| Group-A | ||

| 1 | English Composition | 50 |

| 2 | General Knowledge, Current Affairs of National & International Importance, History of India & Indian National Movement, Geography, Reasoning | 40 |

| 3 | Constitution of India with special reference to NITI Aayog, (erstwhile Planning Commission), Finance Commission, Finance, Accounts & Audit | 35 |

| Group – B | ||

| 1 | Business Mathematics & Statistics | 35 |

| 2 | Accountancy & Costing | 40 |

| Total | 200 | |

Mains Examination

Mains Examination will be held in two parts namely a Written Test and a Personality Test. The Written Exam will consist of Compulsory and Optional Papers. Each Compulsory and Optional Paper will be 100 marks. The time allotted for Mains Examination is 3 hours. Finally, Personality Test will consist of 200 marks.

| Sl.No | Main Examination (Descriptive) | Marks |

| 1(a) | Compulsory Papers (100 marks for each paper):A. English Essay, Precis Writing & Composition. B. Bengali/ Hindi/ Urdu/ Nepali/ Santali Essay, Precis Writing & Composition. C. General Knowledge & Current Affairs. D. Business Mathematics & Statistics. E. Auditing |

500 |

| 1(b) | Optional Papers (100 marks for each paper) : Candidates shall have to choose three (3) papers taking one from each group, viz. Group – A, Group – B & Group – C. Group – A: A 1: Macroeconomics & Public Finance. A 2: Indian Financial System. A 3: Economic Principles & Indian Economic Problems. Group – B: B 1: Business Regulatory Framework. B 2: Cost & Management Accounting. B 3: Advanced Accountancy. Group – C: C 1: Business Management. C 2: Direct & Indirect Taxation. C 3: Information Technology & its application in Business. |

300 |

| Sub Total | 800 | |

| 2 | Personality Test | 200 |

| Total | 1000 | |

WBPSC Audit and Accounts Service Exam Syllabus 2022

In order to guide, candidates toward success in the examination, we have provided the West Bengal Audit and Accounts Service Exam Syllabus. A candidate attending the exam can take the help of the West Bengal Audit and Accounts Service Syllabus for scoring maximum marks in the exam. One can excel in exams only by proper study plans and preparation. For any exam candidates should have a syllabus during preparation. Download WBPSC Audit and Accounts Service Exam Syllabus PDF and make it as a support during the preparation. In addition, West Bengal Audit and Accounts Service Exam Syllabus topics help to obtain a decent score in the exam.

Compulsory Paper – D Business Mathematics & Statistics

- Ratio and Proportion with simple applications.

- A.P., G.P., Convergence, and Divergence of G.P. series.

- Permutations:- Definition, Factorial notation, Theorems on permutation, Permutations with repetitions, Restricted permutations.

- Combinations:- Definition, Theorems on the combination, Basic identities, Restricted combinations.

- Logarithm:- Definition, Base, and index of the logarithm, General properties of the logarithm, Common problems.

- Compound interest and Annuities:- Different types of interest rates; Concept of present value and amount of sum; Types of annuities; Present value and amount of an annuity including the case of continuous compounding; Valuation of simple loans and debentures; Problems relating to sinking funds.

- Set Theory:- Definition of Set; Presentation of Sets; Different types of Sets-Null Set,

- Finite and Infinite Sets, Universal Set, Subset, Power Set, etc.; Set Operations; Laws of Algebra of Sets.

- Correlation and Regression:- Scatter diagram; simple correlation coefficient; Simple regression lines; Spearman’s rank correlation; Measures of association of attributes.

- Index Numbers:- Means and types of index numbers; Problems in constructions of index numbers; Methods of construction of price and quantify indices; Tests of adequacy; Errors in index numbers; Chain-base index numbers; Base shifting, splicing, deflating; Consumer price index and its uses.

- Interpolation:- Finite differences; Newton’s forward and backward interpolation formula; Lagrange’s interpolation formula.

- Measures of Central Tendency:- Common measures of central tendency – mean, median, and mode; partition values-quartiles, deciles, percentiles.

- Measures of dispersion:- Common measures of dispersion range, quartile deviation, mean deviation, and standard deviation; Measures of relative dispersion.

Compulsory Paper – E Auditing

- Definition and Scope of Auditing.

- Classification of Auditing.

- Divisible Profits.

- Divisible profits and Dividend-concept.

- Treatment of Depreciation.

- Reserve and Provision.

- Auditor’s report and certificate.

- Concept of True and Fair view-Materiality.

Group – A

Paper A1:- Macroeconomics & Public Finance

- Macro Economics

- Public Finance

- Principles of Taxation and government expenditure-benefit approach.

- The excess burden of taxes

- Development of Federal Finance in India-The constitutional arrangements.

- Finance Commissions.

Paper A2:- Indian Financial System

- Financial system

- Money and Indian banking System :

- Capital Market

- Interest Rate Structure

- Money Market

- Financial Services

- Investors; Protection

- Other Financial Institutions.

Paper A3:- Economic Principles and Indian Economic Problems

- Introduction

- Basics of Demand and Supply

- Theory of Consumer Behaviour

- Theory of Production

- Theory of Cost

- Market for Commodities

- Factor Price Determination

- Overview of Indian Economic Trends

- Issues in the Indian Economy

- Problems and Policies of the Indian Economy

- Indian Economic Planning

Group – B

Paper B1: Business Regulatory Framework

- Indian company Law

- Sales and Goods Act

- Indian Partnership Act

- The Indian Contract Act

- The Negotiable Instrument Act, 1881

- Consumer Protection Act, 1986

- Employees Welfare Acts (General Idea)

Paper B2: Cost & Management Accounting

- Definition of Material Cost

- Classification of Material Cost

- Materials Purchase Procedures

- Different types of stock levels

- Economic Order Quantity

- Methods of Pricing of issues of Materials

- Motor Transport Costing

- Hotel Costing

- Single or Output costing etc.

Paper B3: Advanced Accountancy

- Nature of Accounting

- Insurance Claims

- Branch Accounting

- Valuation

- Company Final Accounts

- Introduction to Accounting standards

- Cash Flow Statement

- Ratio Analysis

Group – C

Paper C1: Business Management

- Evolution of Management

- Management and society

- Planning

- Organization

- Staffing

- Leading

- Motivation

- Control

Paper C2: Direct and Indirect Taxation

- Income Tax Act

- Sales Act

- Service Act

- Central Excise Act

Paper C3: Information Technology and its Applications in Business

- Fundamentals of computer

- Date organization and Database management system

- Date Communication and computer network

- Introduction to the Internet

- Security Issues

- E-Payment

- Introduction to ERP